While IGE said “it does not comment on speculation as a rule,” it is learnt to be examining bidding for Virgin Australia and has appointed a consultant.

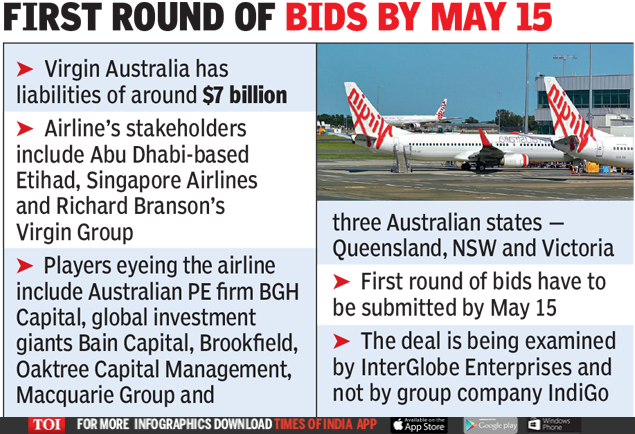

No bids have been put in yet. The first round of bids have to be submitted by May 15. So far, 20 likely bidders have evinced interest.

Virgin Australia stakeholders include Abu Dhabi-based Etihad, Singapore Airlines and Richard Branson’s Virgin Group. The VA deal is being examined by IGE and not by group company IndiGo.

No interest in VA, made no proposal, says IndiGo

VA has appointed a team of Deloitte administrators to “recapitalise the business and ensure it emerges in a stronger financial position on the other side of the Covid-19 crisis” after Australia refused its request for a $888 million loan.

Among the others eyeing VA are Australian PE firm BGH Capital, global investment giants Bain Capital, Brookfield and Oaktree Capital Management, Macquarie Group and three Australian states — Queensland, NSW and Victoria. VA’s total liabilities are close to $7 billion. Morgan Stanley and Houlihan Lokey are conducting the deal for VA’s administrators.

IndiGo, India’s only cash surplus airline is officially out of the VA picture. IndiGo CEO Ronojoy Dutta said in a statement: “We refer to certain reports stating that Indi-Go has expressed an interest in Virgin Australia. We deny the contents of these reports and would like to clarify that IndiGo has not formulated any indicative proposal, nor does it have any interest in this matter.”

The dynamics of aviation industry will change significantly in a post-pandemic world, with several airlines struggling to survive and some looking for infusion of funds from new investors to revive. Among Indian carriers, IndiGo is the only one with its own cash reserves. Other airlines like GoAir and Vistara are backed by promoters with deep pockets, while state-owned Air India’s divestment process is on. IndiGo has been planning to spread its wings abroad for a long time.

Source link