Following is a chronology of the central bank’s key comments and actions from February till now:

* February 6: RBI made a passing reference to coronavirus outbreak in China; said softening of crude prices and bearish phase in equities due to coronavirus infections.

* March 3: Issued a statement on COVID-19 outbreak amid market volatility; said it is monitoring developments and is ready to take appropriate actions.

* March 6: Governor Shaktikanta Das said India will be able to respond to the challenges emerging out of the coronavirus epidemic, RBI ready to intervene in whatever way required.

* March 16: RBI writes to banks to ensure operational and business continuity measures, right after the World Health Organisation (WHO) declared COVID-19 as a global pandemic.

* Mid-March: The central bank constituted a crack team of 150 RBI officials to ensure smooth functioning of the financial system.

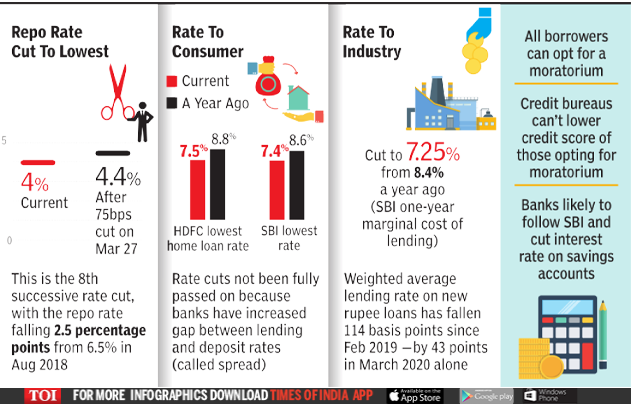

* March 27: RBI announced repo rate cut by 75 basis points (bps), reduction in CRR by 100 bps, long-term repo operations (LTRO) to infuse Rs 1 lakh crore liquidity and other measures after first Monetary Policy Committee (MPC) meet following the pandemic. The meet was preponed by a week.

It also announced three-month moratorium on all loan repayments till May 31.

* April 3: RBI reduced daily money market trading time to four hours from 10 am to 2 pm.

* April 17: The central bank slashed reverse repo rate by 25 basis points and other measures.

It also announced a special finance facility of Rs 50,000 crore for Nabard, Sidbi and National Housing Bank, targeted LTRO of Rs 50,000 crore and changes in NPA classification to exclude the 90-day moratorium period.

* April 27: RBI announced a Rs 50,000 crore special liquidity facility (SLF) for mutual funds.

* May 22: Shaktikanta Das announced repo rate cut by another 40 bps after second MPC meet, which was also preponed. It also extended the three-month moratorium on repayment of loans to banks by another three months till August 31.

Source link